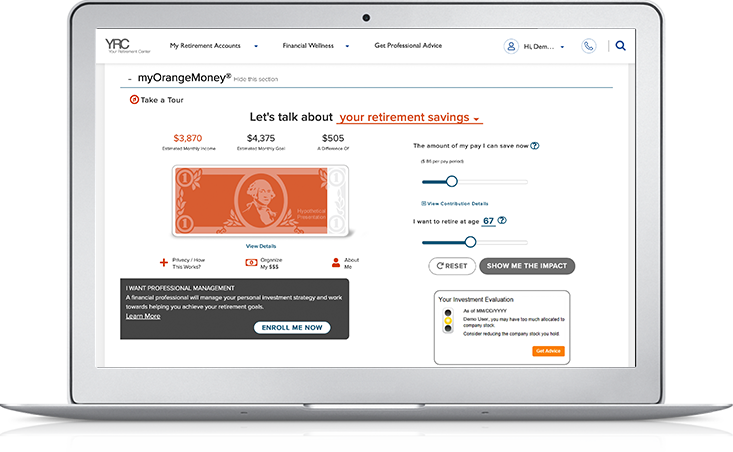

Voya’s myOrangeMoney® is an educational, interactive online experience that estimates how your savings may translate into monthly retirement income.2 It can help you make more informed savings and investing decisions. Give it a try! You can try out the myOrangeMoney calculator.

Financial Wellness is all about finding a balance between living for today, saving for tomorrow, and building confidence along the way. Voya’s Financial Wellness Experience can help guide you on this journey.

Voya Learn offers live and on-demand video sessions that can help you on your journey to financial wellness. You’ll find videos on managing debt, establishing an emergency fund, planning for retirement, insurance, health plans, caring for loved ones with special needs, and much more.

Explore Voya Learn.

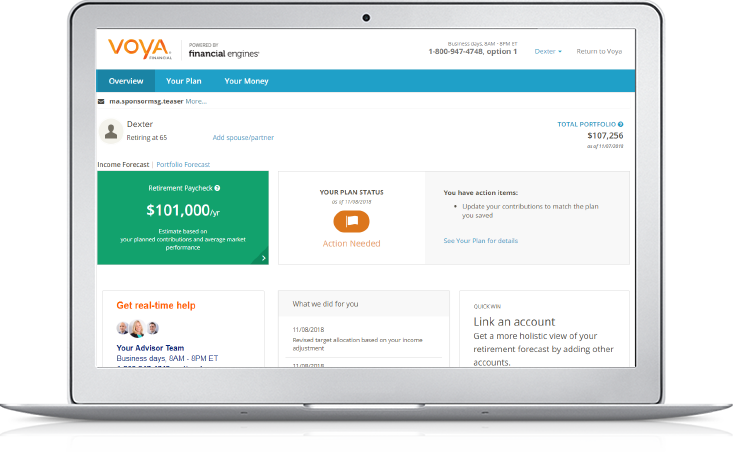

The Plan offers personalized savings and investment advice through Voya Retirement Advisors, LLC (VRA)1

The Voya Cares® program is designed to help Americans with disabilities and special needs—as well as their caregivers—achieve the quality of life they seek today and through retirement. The program makes a difference through advocacy, resources and solutions.

Explore Voya Cares.

The Voya blog offers regularly updated articles on topics like market volatility, Roth IRAs, and maximizing 401(k) contributions. Discover practical tips and insights that will help you Get Ready to Retire Better.®

Visit the Voya blog.

1 IMPORTANT: Forecasts, projected outcomes or other information generated regarding the likelihood of various investment options are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. In addition, results may vary each time a forecast is generated for you.

Advisory Services provided by Voya Retirement Advisors, LLC (VRA). VRA is a member of the Voya Financial (Voya) family of companies. For more information, please read the Voya Retirement Advisors Disclosure Statement, Advisory Services Agreement and your plan’s Fact Sheet. These documents may be viewed online by accessing the advisory services link(s) through the Plan website at PortlandGeneral401k.voya.com. You may also request these from a VRA Investment Advisor Representative by calling the Information Line at 844-PGN-401K (844-746-4015). Financial Engines Advisors L.L.C. (FEA) acts as a sub advisor for Voya Retirement Advisors, LLC. Financial Engines Advisors L.L.C. (FEA) is a federally registered investment advisor and wholly owned subsidiary of Edelman Financial Engines, LLC. Neither VRA nor FEA provides tax or legal advice. If you need tax advice, consult your accountant or if you need legal advice consult your lawyer. Future results are not guaranteed by VRA, FEA or any other party and past performance is no guarantee of future results. Edelman Financial Engines® is a registered trademark of Edelman Financial Engines, LLC. All other marks are the exclusive property of their respective owners. FEA and Edelman Financial Engines, L.L.C. are not members of the Voya family of companies. ©2022 Edelman Financial Engines, LLC. Used with permission.

2 IMPORTANT: The illustrations or other information generated by the calculators are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified professional legal, financial and/or tax advisor when making decisions related to your individual tax situation.